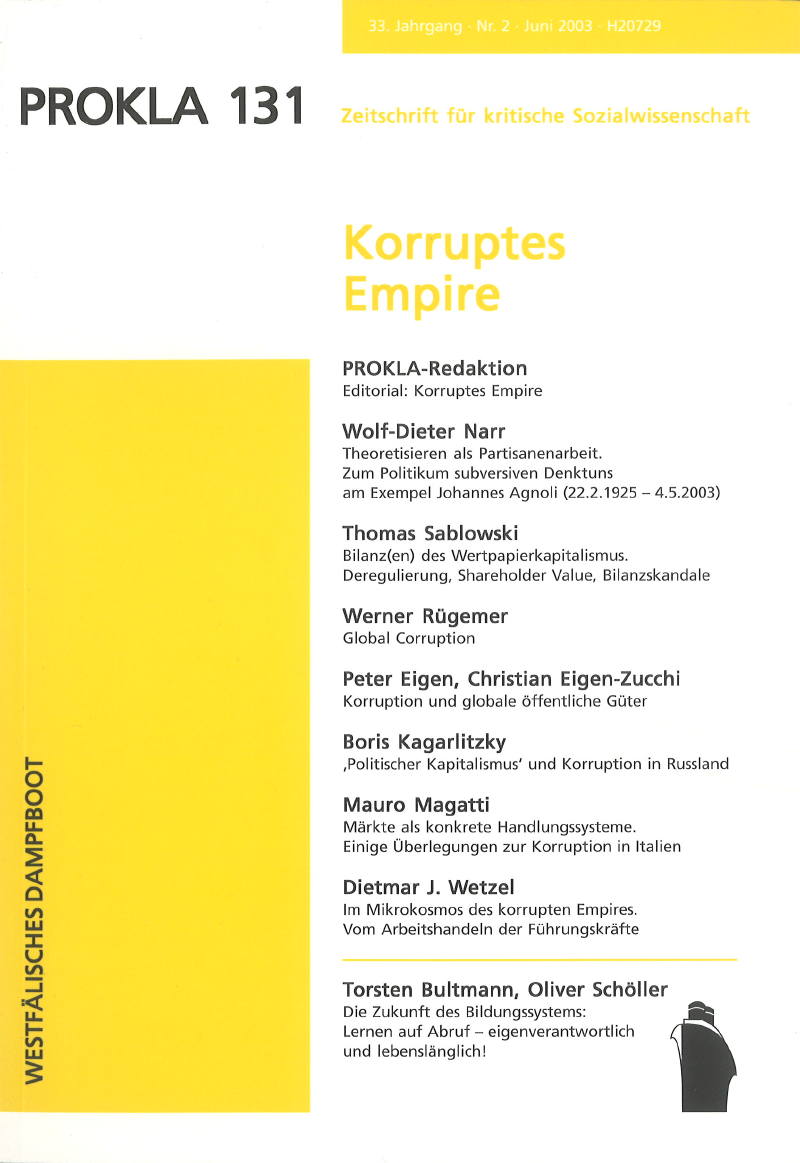

Bilanz(en) des Wertpapierkapitalismus

Deregulierung, Shareholder Value, Bilanzskandale

DOI:

https://doi.org/10.32387/prokla.v33i131.666Keywords:

Deregulierung, Shareholder Value, Korruption, Enron, KapitalismusAbstract

In the public discussion, the series of accounting scandals and bankruptcies which has taken place in the last years is primarily attributed to the greed of managers and institutional lacks in securing shareholder's interests. However, this article argues that it is precisely the proliferation of shareholder value concepts and the growing dominance of "fictitious capital" associated with the development of financial markets which increases the necessity and the possibilities to inflate profits, sales and share prices by all means, including "creative" accounting