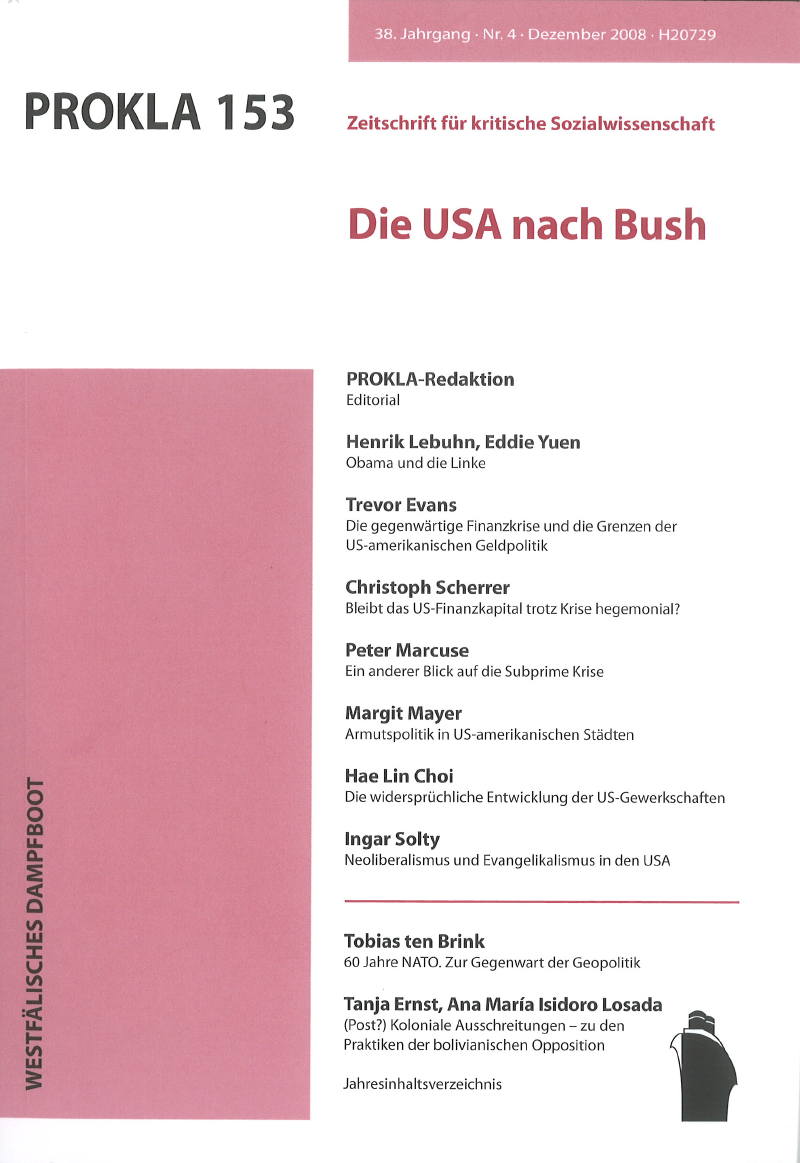

Die gegenwärtige Finanzkrise und die Grenzen der US-amerikanischen Geldpolitik

DOI:

https://doi.org/10.32387/prokla.v38i153.450Keywords:

Krise, Finanzkrise, Geldpolitik, USAAbstract

Since the 1980s, the US has developed a form of finance-led capitalism in which growth has been highly dependent on credit expansion and asset bubbles. Profitability has steadily climbed, and there has been a massive redistribution of income in favour of the top 1% of income earners. But the financial crisis which began in August 2007 and which deepened with the collapse of Lehman Brothers in September 2008 has left this model in ruins. As the traditional instruments of monetary policy proved ineffective the US state was obliged to partially nationalise the financial system. With banks unwilling to lend to even the best-known companies, the US economy is faced with a major recession which is likely to further exacerbate the difficulties facing the financial sector.