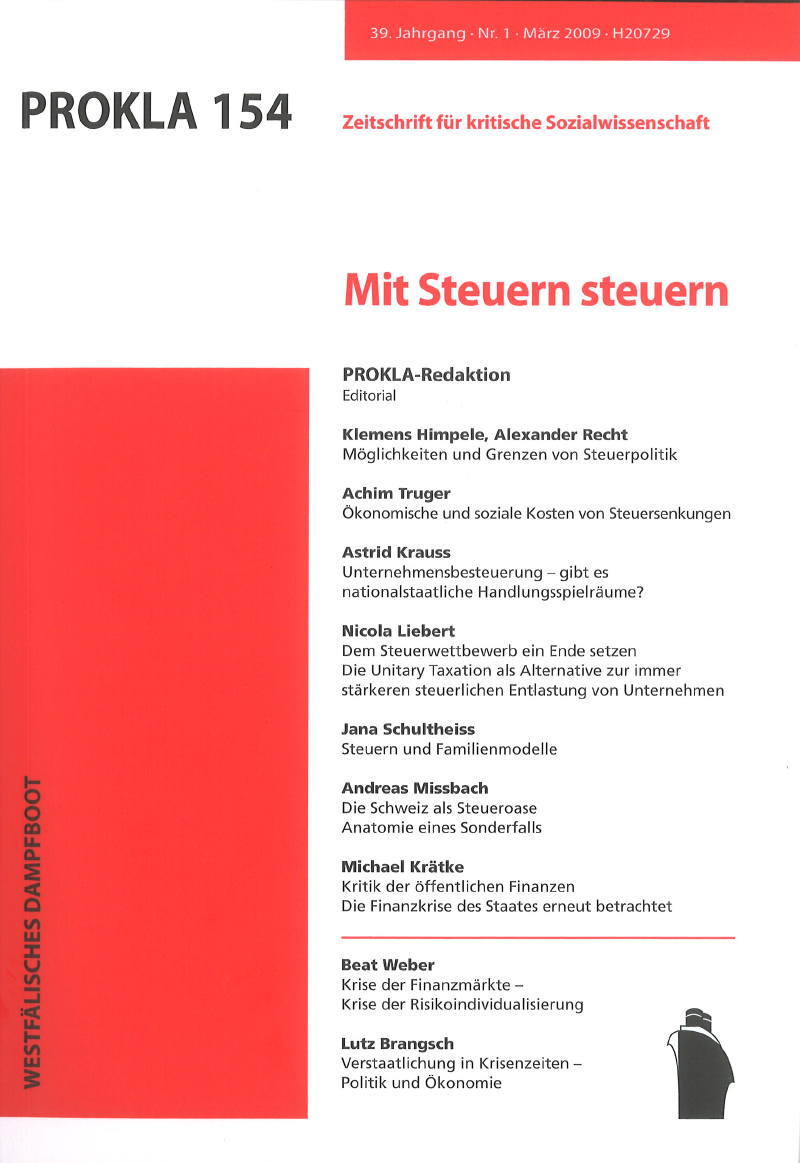

Steuerwettbewerb ein Ende setzen

Die Unitary Taxation als Alternative zu immer stärkeren steuerlichen Entlastung von Unternehmen

DOI:

https://doi.org/10.32387/prokla.v39i154.442Schlagwörter:

Steuern, Unternehmen, Steuerpolitik, DeutschlandAbstract

The global mobility of capital and the availability of tax havens enable multinational corporations and wealthy individuals to escape tax payments due in their home countries. Most states react by shifting more of the tax burden onto labour and consumption, while lowering corporate tax rates in an effort to remain internationally competitive, thereby creating a tax system that is both inequitable and socially and economically unsustainable. However, there is scant evidence that lower taxes on capital in fact contribute to higher investment, but they do lead to profit shifting for the purpose of tax planning. Alternative tax systems such as unitary taxation could help to stop profit shifting and slow down tax competition.