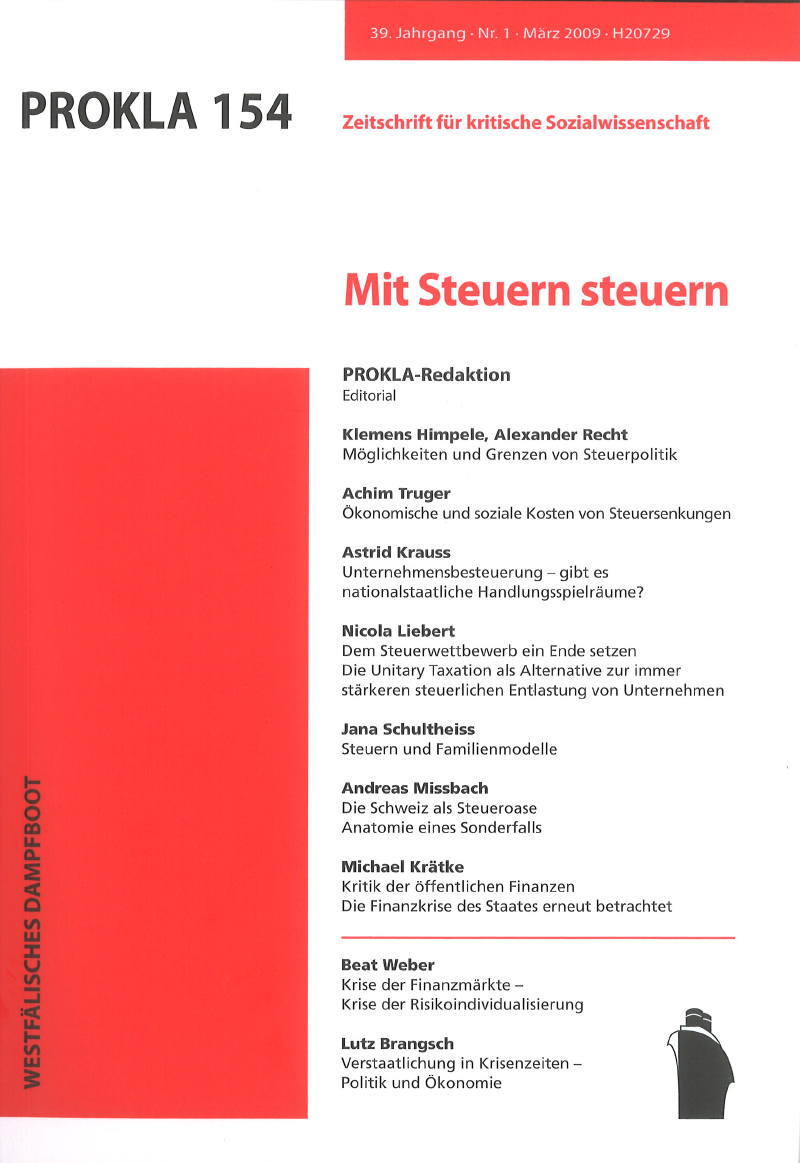

Unternehmungsbesteuerung - gibt es nationalstaatliche Handlungsspielräume?

DOI:

https://doi.org/10.32387/prokla.v39i154.441Schlagwörter:

Staat, Unternehmen, Steuern, SteuerpolitikAbstract

Like Germany, most industrial countries use international tax competition to justifY their corporate tax cuts. They argue that high nominal corporate tax rates will canse a shift of taxable income to low tax countries and reduce their overall economic attractiveness. Although at least the fear of tax evasion is not without any reason in globalised markets, there is scope to increase corporate taxation left unused because a lack of political will. However, the lack of binding international tax standards and harmonisation makes it difficult to stop tax competition effectively and to allow an adequate taxation of global players in the respective countries of economic activities.