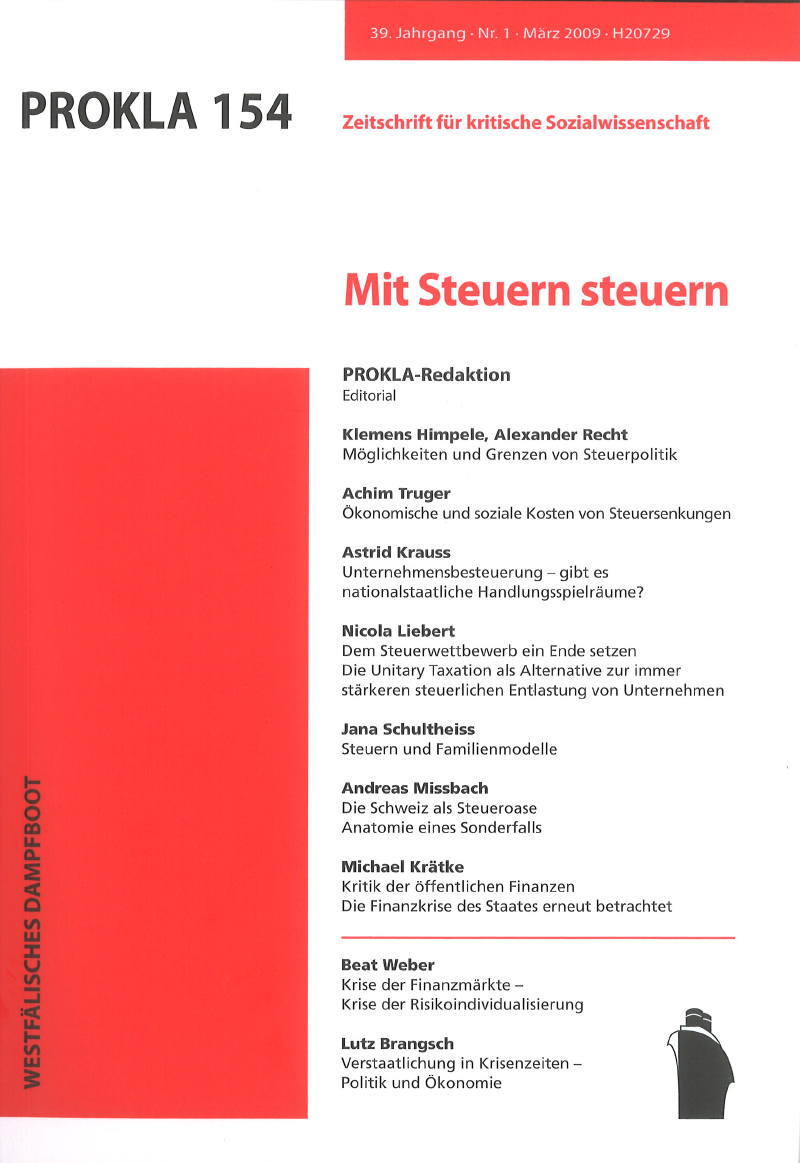

Die Schweiz als Steueroase

Anatomie eines Sonderfalls

DOI:

https://doi.org/10.32387/prokla.v39i154.444Schlagworte:

Schweiz, Steuern, SteueroaseAbstract

Although Switzerland is not a typical tax haven. Switzerlands legal system has some distinctive features that allows foreign individuals and companies to evade taxes, The most important is the distinction between tax evasion and tax fraud. with only the latter being a criminal offense. Therefore Switzerland gives no juridical or administrative assistance in cases of tax evasion, which has helped the country to become the most important offshore private banking place. Roughly one Third of worldwide crossborder private wealth is managed in Switzerland, between 1.25 to 3.6 trillion francs are not taxed in the country of origin.